Insights

The AI Revolution in Pharma – Will 2025 Be the Breakthrough Year?

The AI Revolution in Pharma – Will 2025 Be the Breakthrough Year?

The adoption of AI by biotechnology and pharmaceutical companies has grown significantly, yet its impact on drug approvals remains limited. While no AI-discovered drugs have been approved yet, some of the many AI-driven drug discovery companies launched since 2014 have successfully progressed to clinical trials.

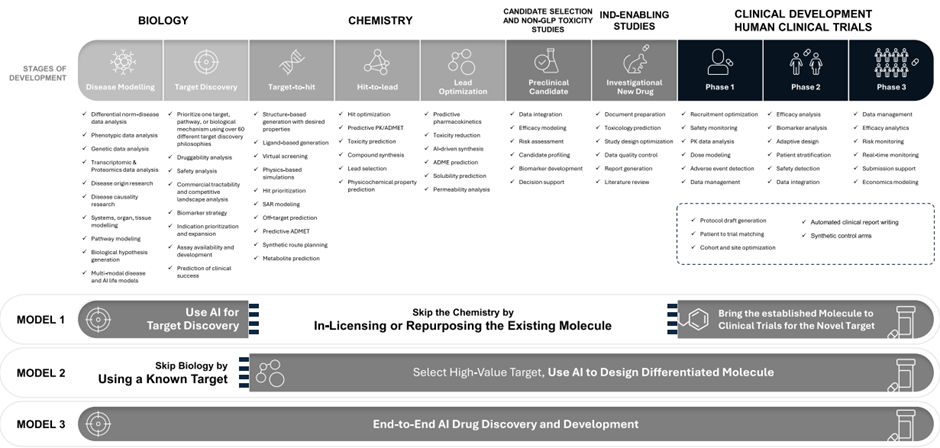

AI-driven drug discovery companies typically follow one of three approaches:

- Repurposing or in-licensing drugs, relying on AI-derived disease-target hypotheses, enabling faster Phase II studies, but carrying high target selection risk and frequent efficacy challenges.

- Design of new molecules, relying on established targets, aiming to create best-in-class treatments while avoiding target discovery risks, though facing significant competition and considerable chemistry risk.

- End-to-End AI platforms, identifying novel targets and developing first-in-class molecules, balancing high target selection risk with moderate chemistry risk.

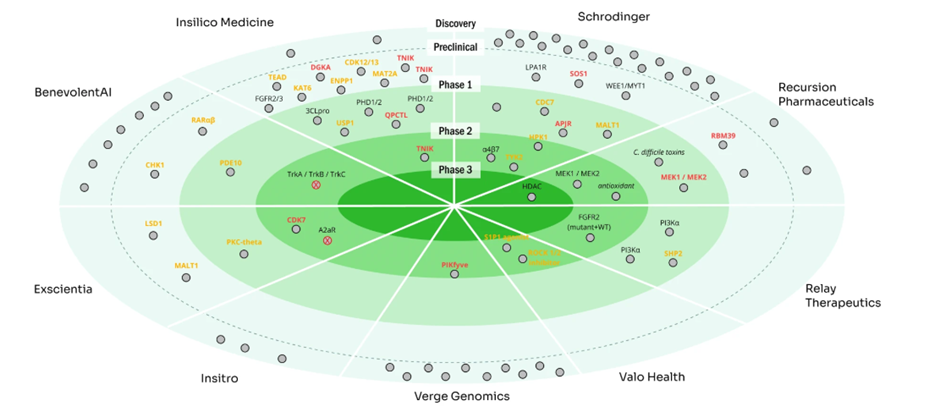

Thirty-one drugs were undergoing human clinical trials, developed by eight leading AI drug discovery companies as of April 2024. Nine of these were in Phase II/III (with one reporting non-significant findings), five were in Phase I/II (including one discontinued), and 17 were in Phase I (with one trial ended). While progress is evident, the journey to tangible breakthroughs continues.

Recent Setbacks in AI-Driven Drug Discovery

Unfortunately, in recent months, we have seen several additional setbacks:

- Fosigotifator, a candidate developed in collaboration between Calico and AbbVie, which highlights the alliance’s efforts to combine Calico’s computational biology expertise with AbbVie’s drug development capabilities, failed to meet its primary endpoint in a Phase II/III study, showing no significant impact on slowing ALS disease progression after 24 weeks of treatment.

- Neumora announced results from the Phase III study of navacaprant for the treatment of major depressive disorder, demonstrating no statistically significant improvement over placebo.

- Valo Health dropped ROCK inhibitor OPL-0401 after phase II study failed to meet its primary objective of showing a reduction in the severity of diabetic retinopathy after 24 weeks, when compared to placebo.

- Due to elevated liver enzymes levels and potential signs of drug toxicity, BioAge Labs scrapped the Phase II trial just months after IPO, testing oral obesity candidate azelaprag in combination with Eli Lilly’s tripeptide.

Signs of Optimism

- Investor Confidence: Investors remain confident in biotech AI, recognizing the sector’s potential for transformative impacts. With clinical trials typically spanning at least five years, venture capitalists are strategically investing now to position themselves at the forefront of innovation later this decade. According to Silicon Valley Bank, biotech AI attracted $5.6 billion last year, nearly 30% of healthcare startup funding, reflecting a nearly threefold increase driven by mega-deals Additionally, a 2023 Deep Pharma report highlights that since 2015, investments in 800 AI-driven pharma companies have surged 27-fold, reaching a cumulative $56.3 billion.

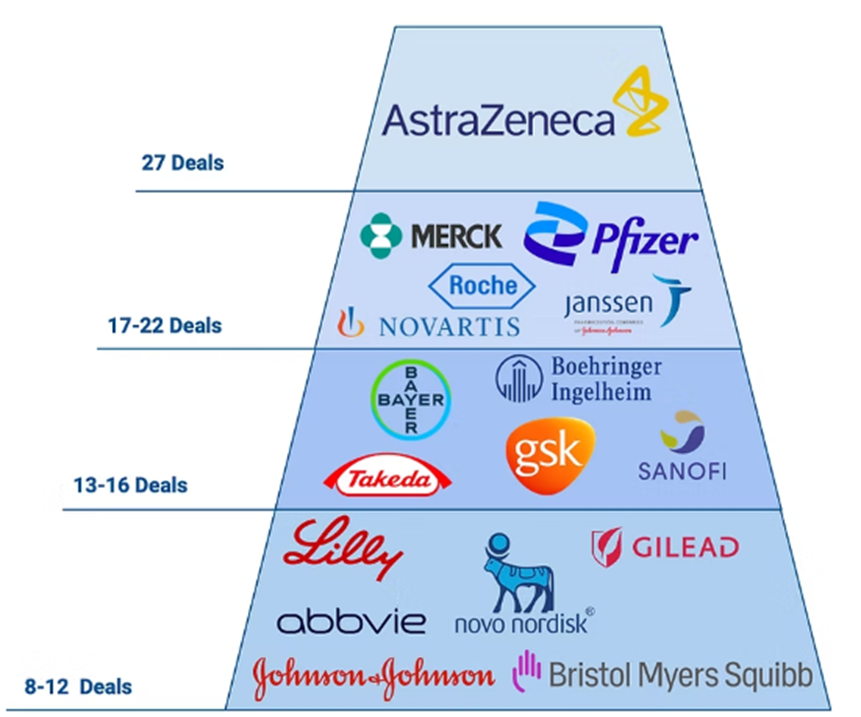

- Pharma Partnerships: As AI transforms drug discovery, major pharma companies are increasingly collaborating with AI startups to stay competitive and address declining R&D efficiency. Leading the industry in major partnerships are AstraZeneca (27 collaborations) and Merck (22 collaborations)

- Clinical Progress: Progress in AI-driven drug discovery is becoming increasingly evident. Insilico Medicine announced Phase IIa trial results for ISM001-055, a drug targeting idiopathic pulmonary fibrosis, demonstrating significant improvements in lung function, Recursion shared promising Phase II data for REC-994, a treatment for cerebral cavernous malformation, which met its primary safety and tolerability endpoints, and Lantern Pharma reported positive updates from its Phase II trial, showcasing the efficacy of LP-300 in treating advanced NSCLC in non-smokers.Diversified Business Models: Many AI-driven drug discovery (AIDD) companies are diversifying their business models to add resilience and reduce risk instead of relying solely on asset generation. For example, Schrödinger offers SaaS for molecular and material design while also developing a therapeutics pipeline, which is split between proprietary and partnered programs.

- FDA acceptance and embracement of AI continues, taking significant steps forward in integrating AI into regulatory decision-making with the release of its first draft guidance. This document outlines a risk-based framework for assessing the credibility of AI models in specific contexts of use (COUs), emphasizing the importance of aligning the level of scrutiny with the potential impact of the AI. The guidance also encourages early engagement with the FDA by sponsors, tech companies, and AI developers to address challenges and ensure appropriate implementation. Building on its experience reviewing over 500 AI-related regulatory submissions since 2016 and input from public workshops, industry experts, and academic leaders, the FDA aims to foster innovation while maintaining the highest standards of safety, effectiveness, and regulatory rigor. This marks a critical milestone for AI integration in drug and biological product development. Read more about the guidance here.

On average, the journey from discovery to market takes 10-12 years, meaning the full impact of AI-driven drug discovery is still unfolding. Even if AI successfully cuts this timeline in half, its ultimate potential remains uncertain since the first fully AI-designed drugs entered clinical trials in 2020 and are still making steady progress through the pipeline. With initial trial results on the horizon, 2025 could be a pivotal year in assessing AI’s role in shaping the future of drug development.

Here are some key updates from the Israeli TechBio sector in the second half of 2024

As the global AI-driven drug discovery landscape continues to evolve, Israeli BioTech companies are making significant strides, securing funding and advancing innovative platforms. These developments highlight Israel’s growing role in shaping the future of AI in pharma, with startups leveraging cutting-edge technologies to drive precision medicine, biomarker discovery, and drug development.

- The AI-driven peptide therapeutics company, Pepticom, has successfully closed a $6.6 million Series A1 funding round, led by Japan-Israel High Tech Ventures 2 LP, to accelerate the development of Pepticom’s oral IL-17 inhibitor program, aiming to deliver improved treatments for autoimmune diseases.

- Senseera has raised $7.1 million in a seed funding round led by Lightspeed Venture Partners. The funding will drive the advancement of the company’s GEM BIOMARKERS liquid biopsy platform, which utilizes cfChIP-seq technology to decode cell-specific gene expression and cell states from blood samples, offering the potential to enhance the diagnosis and management of various conditions.

- Precision medicine startup Promise Bio emerged from stealth with an $8.3 million seed investment, led by Awz Ventures. The funding will accelerate the development of its computational platform, which uses epiproteomics and AI to predict patient treatment responses and support drug research and development.

- NeuroKaire (formerly GenetikaPlus) has raised $10 million in Series A funding, led by GreyBird Ventures, to advance its innovative blood-based platform, providing personalized insights into brain function and drug response, helping clinicians identify the optimal antidepressant for each patient and improving treatment outcomes for depression.

- Immunai secures an $18M collaboration with AstraZeneca to enhance the efficiency of cancer drug trials. Using Immunai’s AI-driven immune system model, the partnership will focus on optimizing clinical decision-making, including dose selection, mechanism of action analysis, patient responder vs. non-responder differentiation, and biomarker discovery.

- Converge Bio has raised $5.5M in Seed funding, led by TLV Partners, to accelerate drug discovery and development. The company leverages GenAI and large language models (LLMs) trained on biological and chemical data, including DNA, RNA, protein sequences, and small molecules, to drive innovation in the field.

The Israeli health tech sector has shown remarkable resilience in 2024, pushing global innovation forward despite economic and geopolitical challenges. Private funding reached $1.2 billion, with pharma/biotech contributing $262 million.

One of the most notable shifts was a significant rise in average funding per deal, reflecting the global trend toward larger investments. The average deal size more than doubled, climbing to $4.6 million across 102 rounds, compared to $2.16 million across 150 rounds in 2023.

This growth underscores the sector’s ability to adapt and thrive in a challenging environment. For further insights, explore SNC’s comprehensive health tech landscape map.